May 27, 2022

2 min read

"Trust experience" will create growth momentum for Banks

This is shared in the presentation of the representative of GEEK Up at the Vietnam - Asia Digital Transformation Summit 2022 (Vietnam - ASIA DX Summit 2022). These are experiences in designing digital experiences, helping businesses stay connected with customers on technology platforms. Since contributing to strongly promoting the successful digital transformation process at Finance - Banking enterprises in the country and in the region.

On May 25th-26th 2022, the Vietnam Software and IT Services Association (VINASA) organized the Vietnam - Asia Digital Transformation Summit 2022 (Vietnam-ASIA DX Summit 2022) under the sponsor of the Ministry of Information and Communications. With the theme "Digital Transformation Synergy for Digital Economy", 2022 is the first year the Forum is held on a regional scale, with the expectation of gathering possible resources from the state, the private sector to the public, international organizations, entrepreneurs, engineering team... In the development strategy of the Government's digital transformation, Vietnam focuses on 3 goals: digital government, digital economy and digital society.

As a technology enterprise focusing on developing digital products that create a positive impact for businesses and customers, GEEK Up has brought to the forum in-depth experiences and practical lessons learned in the successfully developed digital product process for more than 80 partners, through more than 120 digital products and 480 domestic and foreign projects.

Create a "trust account" in customers

Cụ thể, trong phiên dẫn dắt tọa đàm chuyên đề “Chuyển đổi số ngành Tài chính, Ngân hàng - Phát triển kinh tế số”, ông Hoàng Nguyễn - Giám đốc Thiết kế Sản phẩm số GEEK Up cho biết, mức độ tăng trưởng, uy tín của một doanh nghiệp trên thị trường được đo đếm bằng niềm tin của khách hàng. Điều này càng thể hiện rõ nét trong lĩnh vực ngân hàng, thậm chí không ít ngân hàng xem đây là “tài sản” quan trọng không kém doanh thu, lợi nhuận hay nguồn nhân lực. “Khi ai đó quyết định chọn ngân hàng để giữ tiền của họ, cũng xuất phát từ niềm tin đối với ngân hàng đó”, ông Hoàng nói.

Specifically, in the session leading the seminar "Digital Transformation of Finance and Banking - Digital Economy Development", Mr. Hoang Nguyen - Chief of Product Design GEEK Up said that the growth rate and the reputation of a business in the market is measured by the trust of its customers. This is even more evidence in the Banking sector, and many Banks consider this as an important "asset" as revenue, profit or human resources. “When someone decides to choose a bank to keep their money, it also comes from trust in that bank,” Mr. Hoang said.

Investment Newspaper also said that in the flow of brand competition, Vietnam's Finance and Banking industry is developing strongly along with a constant race to attract and maintain customer trust. Opening an account means that customers give their trust to the brand they choose. This is also considered as a "trust account" that Banks have tried to build for their customers.

However, Banks have faced with the challenge of creating and maintaining trust on the digital platform. In particular, the most difficult is the problem of capacity building and finding a team to develop technology products that can ensure the understanding and seamless integration with other channels of Banks.

Design trust experience, create Banking momentum to increase

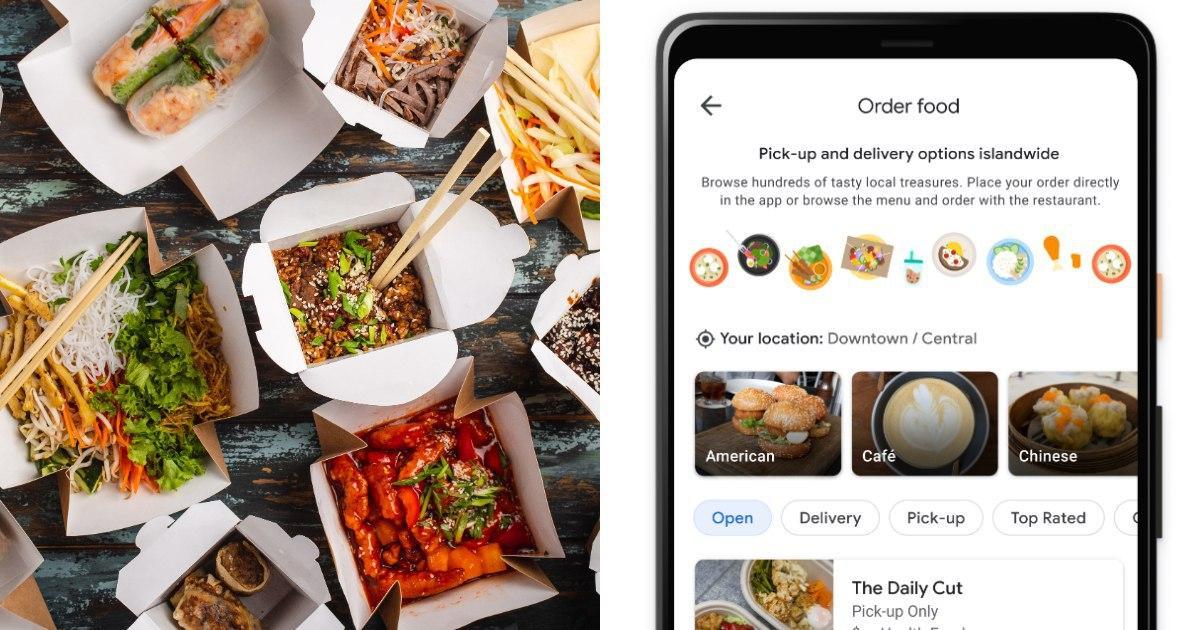

Customers are increasingly demanding to trust the bank's brand. Especially the Gen Z generation, the customer segmentation is born in the internet age that has become popular. They are the ones who have much higher expectations for digital product experiences than previous generations. They are easy to try and use, and also easy to give up, therefore requiring Banks to have sufficient technological capacity to respond as well as to continuously improve and innovate.

Reports from Victoria Petrock, Edelman, WP Engine and NextWave (research of 5000 to 8000 Gen Z people) indicate that 51% of them view Fintech as trusted financial brands and 75% of them will buy or use personalized products.

With experience in designing digital experiences for leading Banks and Financial institutions in Vietnam, a representative of GEEK Up said that in order to maintain and strengthen trust from customers, through digital products, Banks may consider the following factors:

- Aesthetic effect: Eye-catching products are often favored by users. To increase aesthetics, digital product designers must constantly capture market tastes. In addition, attention should be paid to the amount of information displayed. The provided information should only stop at a sufficient level, avoiding creating a feeling of too much, confusion leading to confusion and doubt.

- Synchronize the experience: When users need to perform repetitive tasks, and interact in the same way, it is easier for them to form habits. This creates many advantages when Banks launch new products, users will not have to spend a lot of time learning how to use.

- UX Writing - Designing experiences through words: Not only interested in images and services, modern consumers also pay attention to how Banks communicate through applications. The more transparent of information, going straight to the point will help users feel more secure and confident. Banks can also limit technical jargon and create a person-to-person experience for better customer interactions.

In particular, in the role of a strategic consulting service provider and digital product development in the digital transformation service ecosystem, GEEK Up also provides close analysis of outstanding projects that have been implemented by Banking partners so that businesses can reflect and have more useful perspectives for their brand, thereby building a suitable product development roadmap towards the goal of rapid development, efficiency and sustainability.

Source: nss.vn

3 likes

Get latest updates from GEEK Up

Our email packed with digital product insights, trends and case studies.