June 23, 2022

5 min read

Re-live GEEK Up DPA 8: Finding solutions for balancing technology and emotions for Digital Banking

On June 16th, 2022, the 8th Digital Product in Action (DPA) event officially took place, with the main theme being "Connecting customers through thousands of emotional touch points". In this event, attendees are updated with new trends in Fintech & Digital Banking. At the same time, finding a solution to solve the problem of balancing technological and emotional "equation" for Digital Banking.

The following article summarizes the valuable content from DPA8.

Participating in the workshop are 3 experienced experts in the fields of Digital Banking, Marketing Research, User Experience and Application Development:

- Ms. Mai Võ – Territory Sales Manager at CleverTap

- Mr. Nguyễn Đức Thắng – Vice General Manager – DX at CMC Technology & Solution

- Mr. Hoàng Nguyễn – Chief of Product Design at GEEK Up

Part 1 – Empathy Digital Banking: The problem of "emotionalizing" each touch point

The workshop started with an introduction about Empathy Banking by Ms. Mai Vo – Territory Sales Manager from CleverTap. Accordingly, she said that the important point in the digital era is still to stay engaged with customers. Thereby improving the quality of the customer experience, and creating their loyalty in the long term. It is also an indispensable factor for the Banking & Finance industry, especially for more complex products than usual (such as mortgage loans, home loans or car loans...).

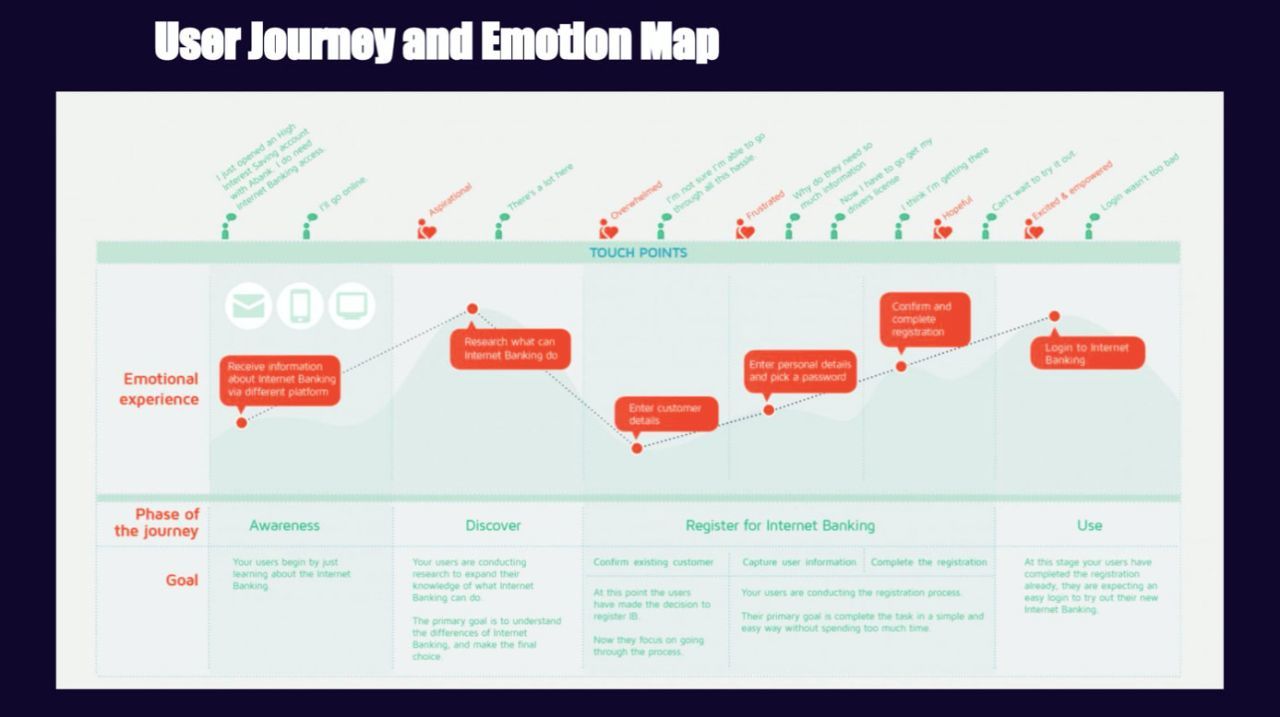

Among the touch points, Ms. Mai pointed out that mobile and website are the two channels that record more and more users interacting with the Banking & Finance brand after COVID-19. So how do Banks solve the problem of "emotionalizing" touch points? She introduced the User Journey & Emotion Map model - the process of converting customers' emotions from recognizing and discovering brand products to signing up for services.

Each user will have different feelings and thoughts at each stage. For example, brand-new customers will search for information and acquire multiple fields of information from many different platforms. Now the brand needs to appear where this user group is looking for information; strike the emotion of eagerness to find out and provide the right information to the desire; thereby convincing them to use the service. Or customers have decided to choose a brand but seem overwhelmed by the information and the process of registering and using the product. Therefore, brands need to actively soothe and encourage users, and at the same time improve the registration process to use the service so that it is more convenient.

Thus brands need to be consistent between the User Journey and the emotions of the user at each stage, in order to provide a relevant experience. As a result, customers see the brand's effort in listening, understanding and meeting their needs. Personalization is the solution for brands to create the most relevant customer interactions possible. At this point, Ms. Mai pointed out three main factors affecting the personalized experience for customers that the Banking & Finance brands should pay attention to, including:

Analyze the consumer audience (Audience Analytics) to understand the behavior of TA, as well as what are the barriers that prevent them from using or stopping from signing up for the brand's services.

- Segment customers (User Segmentation) into groups with similar behaviors and goals at each stage in the User Journey to devise a more appropriate approach strategy

- Omni-channel Communication helps expand the opportunity to reach customers of the brand. For example, older customers, although using smartphones, rarely or even do not use email. Therefore, brands need to find a way to interact with this group via SMS or phone call

- Mai Vo added that A/B testing is an essential step to ensure that the brand's messages (including content, style) touch the emotions of customers, and then increase customer retention

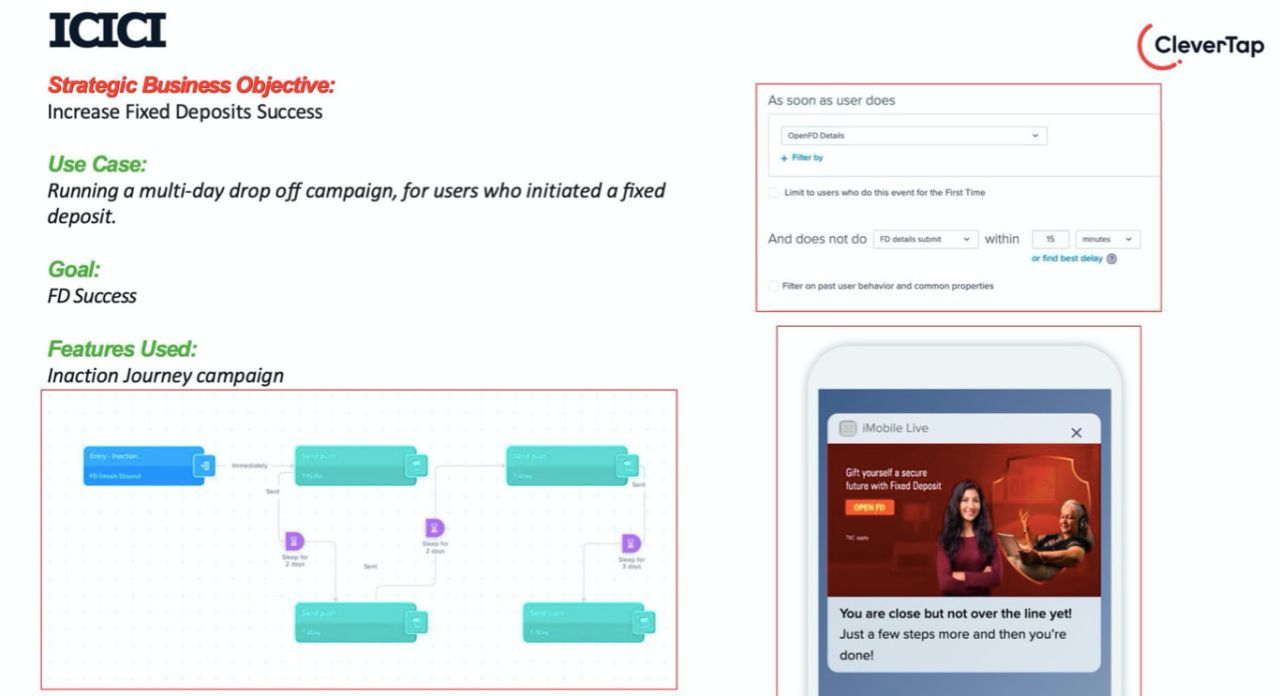

For example, when CleverTap partnered with a famous Indian bank called ICIC, the client's goal was to improve the number of term deposit subscriptions. CleverTap supported ICIC to build interactive journeys automatically, combining push notifications in many different channels. Based on channels that receive little response from customers, brands can determine where users drop as well as the reason for timely support.

Part 2 – Reshaping the customer experience in the Banking industry

Following Ms. Mai's presentation, Mr. Nguyen Duc Thang - Vice General Manager, DX at CMC Technology & Solution, discussed how Banks invest in empathy. He started by outlining four main problems that brands face when pushing services to digital platforms:

- How can banks maintain a personal and emotional connection with customers?

- How do personalize premium banking services?

- How do infuse humanity and personalization into digital channels?

- How do Banks build trust and build new digital products to help customers optimize daily spending and streamline product portfolios?

First, Banks need to build trust with customers by establishing a role as a Trusted Partner. Specifically, there are 2 areas of work that brands need to do: (1) enable the combination of digital and physical experiences; (2) formulating a strategy for mutual development.

With the first mission, Banks should consider to use digital channels to bring efficiency to customers every day with meaningful touch points (in person or remotely). Or optimize branches' operations by combining virtual branches and kiosk services.

As for the development of a joint development strategy, Banks can open up access to finance for low-income consumers and SMEs; or adjust payment methods to support the ecosystem.

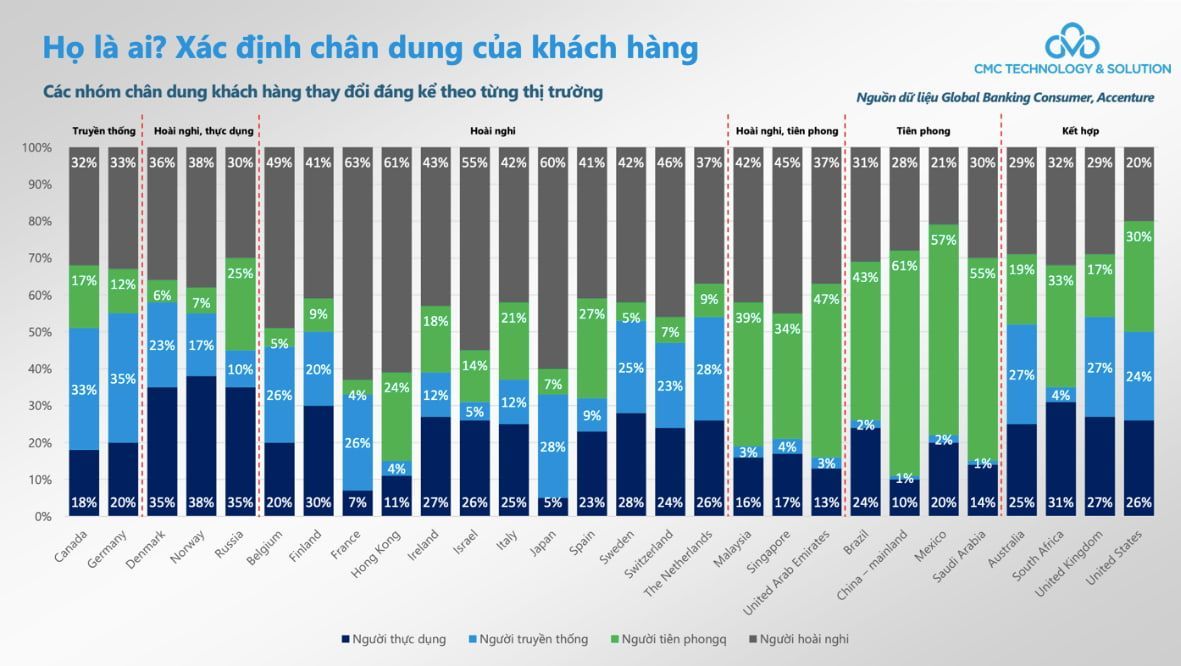

Next, how do Banks invest in empathy? Mr. Thang consulted Accenture's "Global Banking Consumer" report and divided consumers into 4 groups; thereby creating the corresponding approach strategies. Those 4 groups are:

- Pragmatist: They are satisfied with the level of service they receive and expect good value from Banking and Insurance providers. Technology is not a passion

- Conservative: These customers value human contact and limit technology when possible. They show low engagement and satisfaction with their financial service providers, and low trust

- Pioneers: This group consists of risk takers, tech-savvy and avid innovationers. They want to engage with financial service providers through new digital channels and devices

- Skeptics: They are wary of technology and often unhappy with their financial service providers. This group is also the least trustworthy. This personality group makes up 38% of all consumers and is also the largest group in Accenture's research

The reason Accenture divided this group is because in the "hyper-digital" era, digitization, the ability to understand the emotions of customers plays an important role for the organization. From there, Accenture came up with the idea of dividing audiences according to these personality groups to approach customers based on personality. Accordingly, groups of customer portraits vary significantly by market. This is clearly shown in the chart below. In Singapore, for example, 45% are skeptics, 34% are pioneers, 4% are traditionalists and 17% are pragmatists.

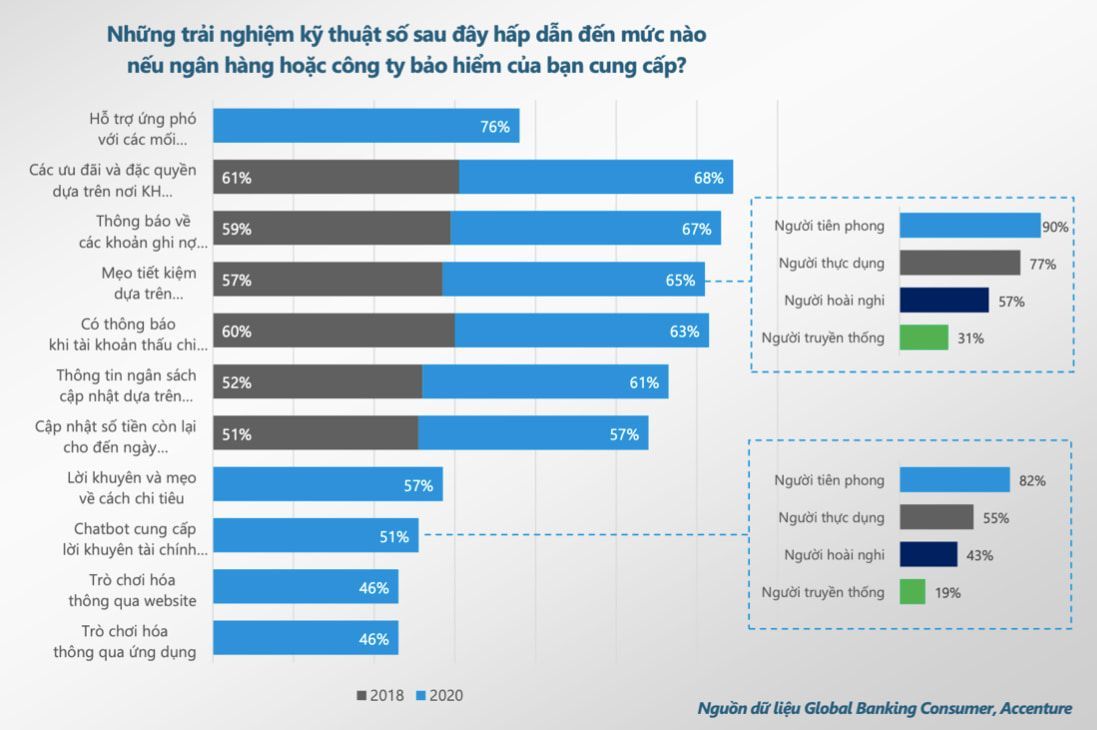

The above report also points out the factors that are valued by users when dealing with Banks. In particular, the factor “value for money” becomes the top concern of customers. Partly as a result of the sudden shift from relatively stable macroeconomic conditions to stress, and uncertainty economic related to COIVD-19. Besides, it is also because Banking services are increasingly digitized, making customers see it as a commodity product. Banks can offer personalized solutions such as savings tips based on customer spending patterns.

Mr. Thang also emphasized that consumers continue to show little interest in the abstract concept of "personalized experience". However, if consumers were presented with specific examples of personalized services, they would have revealed greater interest than two years ago.

Finally, Mr. Thang summarizes the solution to build empathy with customers through the following 5 things:

- Trust is the bank's most valuable asset to attract customers' attention. In an increasingly uncertain world, brands need to show greater empathy and human connection than ever before. Obviously, sincere communication is the basic foundation for creating trust in customers. Banks that make a difference and achieve a high level of customer engagement can drive business growth

- Brand experiences need to be unified and focused on activating brand intent. That is the key to accelerating development in today's experiential landscape

- Branding with purpose. Customers prefer to deal with brands that operate clearly, recognize their responsibilities and are honest. Brand transparency leads to a win-win experience

- Connect company personality to its brand's purpose and values. Many Banking brands often draw futuristic stories. However, they also need to build this story coherently and connect the past, present and future, to represent the brand's goals

- Diverse data enables contextual experiences to be built. Thereby creating connections with the community and bringing real value to customers

Part 3 – "Tailor-made" empathetic digital experiences with Hyper-personalization

Coming to the presentation of the expert from GEEK Up, Mr. Hoang Nguyen - Chief of Product Design once again emphasized the importance of trust for the Banking & Finance brand. Besides business and operational capabilities, brands also need technological capabilities to create products that bring positive impact and value. Following the philosophy of GEEK Up, these products are called Impactful Products. Such quality products will create a firm trust in customers.

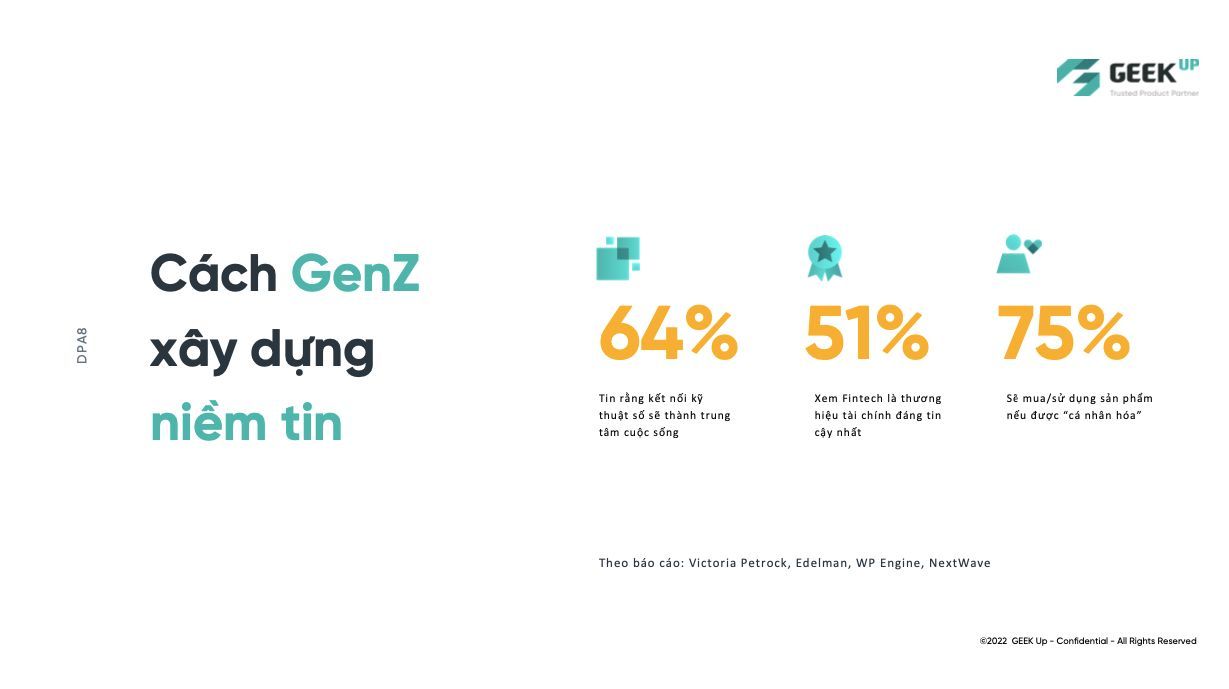

Mr. Hoang especially noted about the world's next major consumer group – Gen Z. He brought up the outstanding figures drawn from the Victoria Petrock, Edelman, WP Engine, NextWave reports to show how Gen Z builds their trust. Specifically:

- 64% of Gen Z believes their upcoming lives revolve around a digital environment where everything is connected. And Gen Z is also known as a digital native when from an early age, they have been exposed to the internet, social networks and mobile phones

- More than 51% consider Fintech the most trusted financial brand. Perhaps the current bank has not been able to keep up with the social situation. This leads to a decrease in consumer confidence. Therefore, many Gen Z prioritize investment in Fintech and applications for better financial management

- 75% of Gen Z answered that they would choose a product containing stories and information related to themselves. Accordingly, they feel that this is a product created for them and are motivated and want to own the product

Có thể thấy để xây dựng lòng tin cho Gen Z tương đối khó vì họ sinh ra trong thời đại internet phát triển mạnh, và trải nghiệm nhiều ứng dụng, sản phẩm khác nhau. Vì thế kỳ vọng trải nghiệm số của Gen Z cao hơn nhiều so với những thế hệ trước. Chính vì vậy, những lĩnh vực như ngân hàng hay Fintech muốn phát triển và thu hút tệp người dùng này hơn cần quan tâm tới năng lực cải tiến công nghệ.

It can be seen that it is relatively difficult to build trust for Gen Z because they were born in the era of strong internet, and experience many different applications and products. Gen Z's digital experience expectations are much higher than previous generations. Therefore, fields such as Banking or Fintech that want to develop and attract this user file need to pay more attention to the ability to improve technology.

Mr. Hoang summarized with 3 design notes to make it easier for Banks to attract consumers:

- How to create a technology product with eye-catching effects, and at the same time harmonize the brand's aesthetics and personality with user tastes? Aesthetics are not only beauty - ugly, but also usability. For example, the amount of information on one screen is too much, which is annoying for the user. Therefore, the mission of the brand is to help users find the desired information as simply as possible. This requires a lot of effort from the brand, because this is also the beginning of creating trust

- Products need to have the same aesthetic, experience and way of interaction. To do that, product teams need to create standards to follow. In case the application is upgraded, ensuring the synchronization of the application helps users quickly understand and get used to the new functions

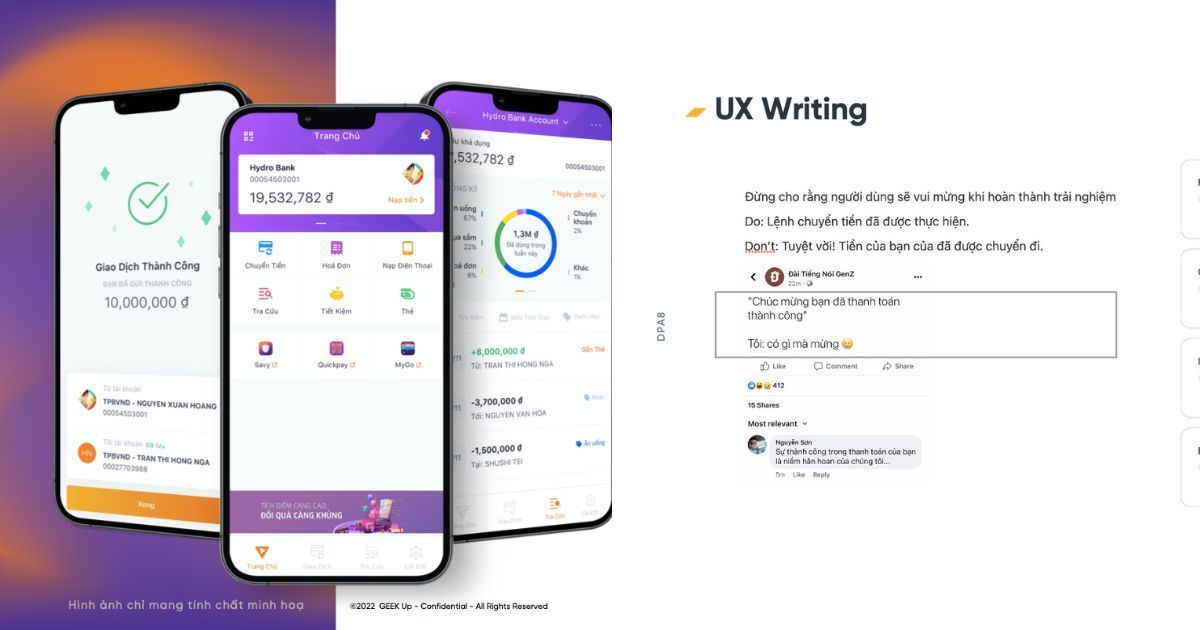

- Enhance the experience through words. Gen Z begins to pay more attention to conversations between themselves and the digital products they use such as apps, websites, etc. Gen Z is also very sensitive to language and popular sayings. So, the brand needs to update the current trend of Gen Z, the Product team also needs to practice language skills to make it more interesting. Above all, the language also needs to stand out to make the brand personality

Nguồn: brandsvietnam.com

1 likes

Get latest updates from GEEK Up

Our email packed with digital product insights, trends and case studies.