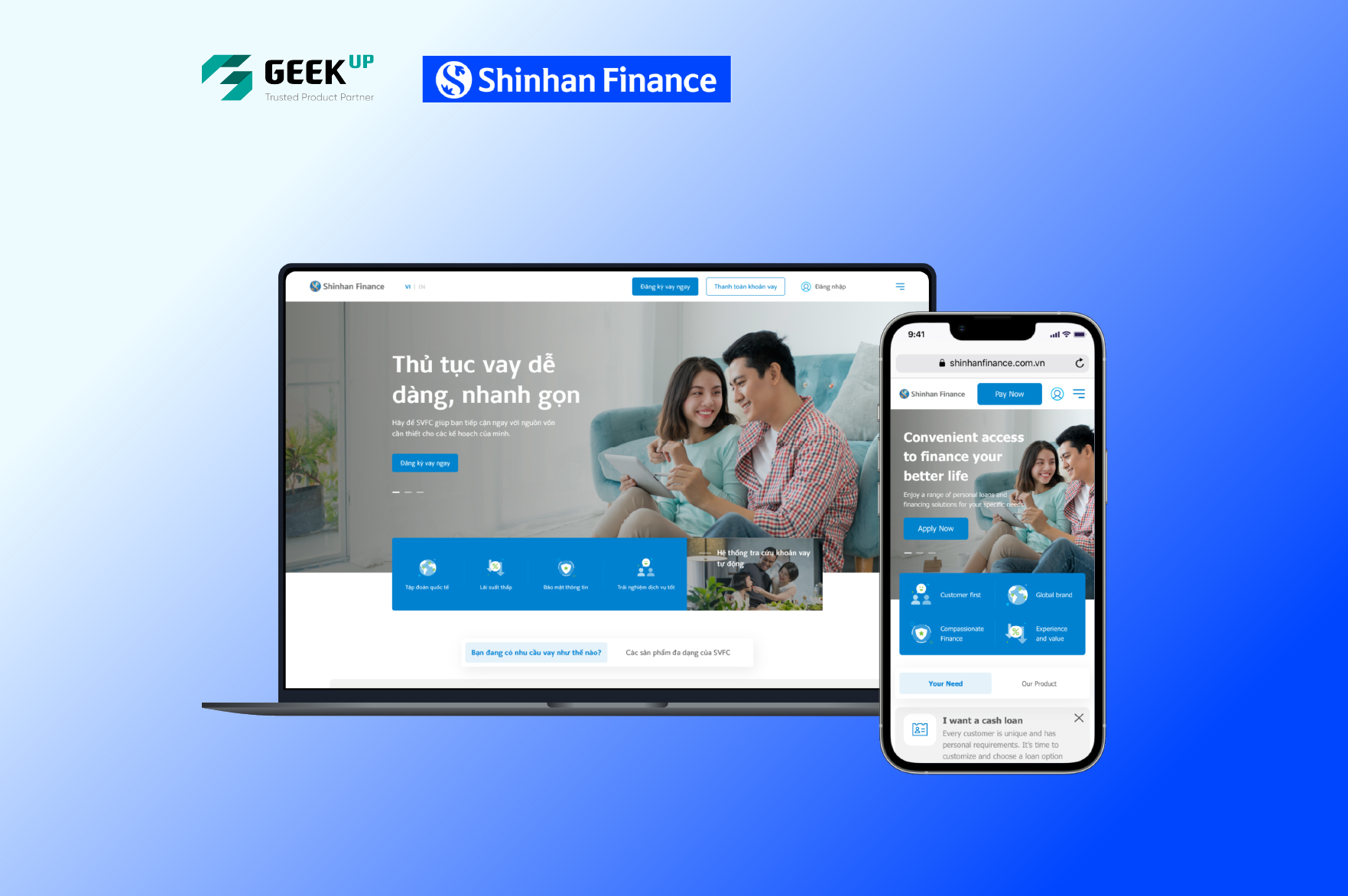

Building an optimal platform for the leading Fintech startup in the peer-to-peer lending market

#FINANCE

#WEBAPP

#MARKETLEADER

Established in 2015, Funding Societies is a digital finance platform whose mission is to connect investors with small and medium-sized businesses that need a loan of less than $1 million. In the period of 2018-2019, the peer-to-peer (P2P) lending market witnessed the rise of the 4.0 technology revolution along with a number of strong competitors. In order to increase competitiveness and enhance their position in the market, Funding Societies has explored and applied technology solutions to enhance operational efficiency. At that time, the Funding Societies biggest problem was that the operating process on their company's website was not optimized in time, the connection between the departments was still fragmented, and the data storage was still manually done by using soft files. In July 2019, Funding Societies decided to cooperate with GEEK Up, trusted product partner, to improve the inadequacies in their operating system."

Our Work

Services

Product Implementation

01Shorten disbursement time

From the insights gathered during the exchange with partners, GEEK Up's digital product development team built the platform, added a series of new features and replaced the old modules on the website, help shorten disbursement time.

02Strengthen the connection between departments

GEEK Up designed a new operating system to overcome the "discontinuity" in the previous process by dividing into small stages, helping employees to update work status quickly, and ensuring information is synchronized continuously between departments.

03Synchronize data storage

The new Funding Societies's operating system is built by GEEK Up ensures that data is stored quickly with high security. It also create the convenience for all employees to access data accurately and faster than the manual archival process before.

The impact

Outcomes

14

days is the shortened time. Thanks to the new platform that reduce the disbursement process from 3 weeks to 1 week

5

markets that Funding Societies has reached, including Malaysia, Indonesia, Singapore, Thailand and Vietnam.

144

million USD in Series C+ equity funding from VNG Corporation, Rapyd Ventures, Indies Capital, K3 Ventures and Ascend Vietnam Ventures (2022).

Awards & Achievement

Winner of the "Business Model" and "People Development" categories at the Brands for Good Asia Awards (2019)

Winner of the Technology Innovation category at the Asia-Pacific Stevie® Awards (2020)

Winner of the Startup of the Year category at Asean Startup Awards 2020

Recognition

The largest Peer-to-Peer Lending Digital Platform in Southeast Asia

Funding Societies held the top position when owning more than 60% of the market share by 2020 (according to New Straits Times).

Funding Societies is one of the 5 fastest growing Fintech businesses in Singapore

Ranked by International Data Corporation (IDC) in 2019.

Share now

Copied link

Copy Link